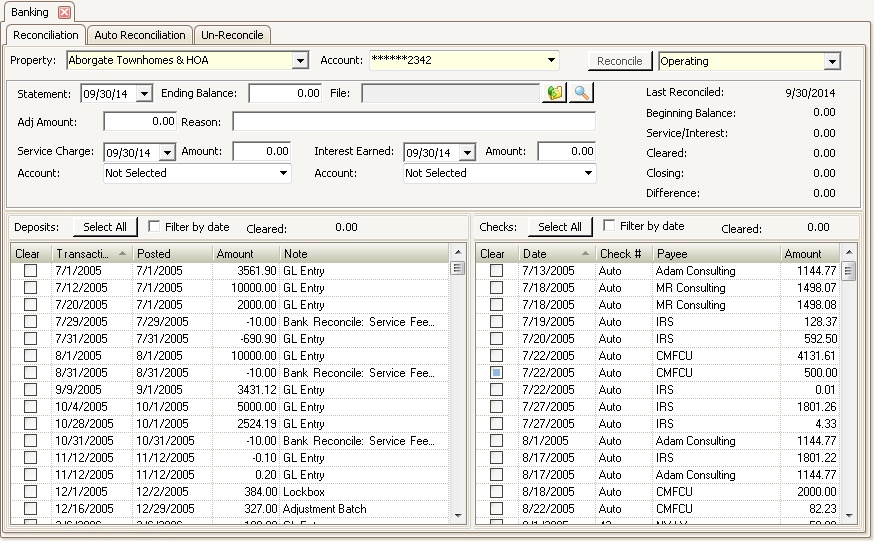

The Banking application is used to reconcile the bank accounts for a selected property for a specific statement period.

The Banking application is accessed through APPLICATIONS | General Ledger Group | Banking.

Prerequisites: In order to be able to reconcile a bank statement, the following must be setup:

▪SETUP | Property Setup | Accounting tab

·Information tab: Under Report Information section, in Bank Reconcile drop down list, select the report that would be printed immediately after posting reconciliation.

·GL tab | Information tab: Normally the Consolidate Reconciliation check box should be checked, leave unchecked if your bank provides separate bank statements per department.

·GL tab | Information tab: The GL Posting Level should be set to either Property Posting (most common) or Community Posting.

·GL tab | Chart of Accounts tab: Create a bank chart of account that is either an Operating or Reserve account Type, link it to a Bank, fill in the Account and Routing numbers.

▪GL activity must be present on the bank account. Activity generated by AR or AP is automatically released to the General Ledger. To view if your bank account has activity go to APPLICATIONS | General Ledger Group | Inquiry.

In this application, there are three tasks the user can accomplish:

1.Reconciliation: Used to reconcile the accounts for a selected property. This tab will show any transactions that have posted to the selected account.

2.Auto Reconciliation: Allows the system to pull in the bank statements for all properties and present anything that has cleared. The management company must be registered with the bank and have set up all the appropriate fields in VMS in order to use this feature.

3.Un-Reconcile: Allows a selected property to be un-reconciled so it can be reconciled again, for any reason.

|

For properties that have been recently added to VMS, the beginning balance is entered as a journal entry. |

|

If your newly added property has outstanding check (check that have not been cash or cleared the bank), it is recommended to enter them as manual checks in Accounts Payable. |