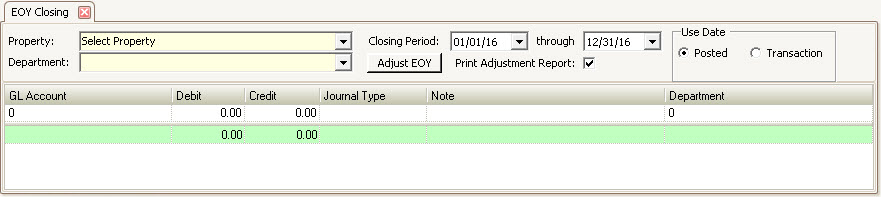

The EOY Closing application is accessed through APPLICATIONS | General Ledger Group | EOY Closing.

The fields on this screen are further defined:

Property |

Select the property to close. |

Department |

Select the department to close (each department must be closed separately). If not selected an information message will appear when attempting to post the EOY entry: "Select G/L department to adjust!". |

Closing Period |

Select the Annual Accounting period that will be closed. |

Print Adjustment Report |

If checked, it will print the G/L Adjustment report that is selected for the property in SETUP | Property Setup | <select property> | Accounting tab | Information tab. |

Use Date |

Select which date method to use when analyzing the GL data to determine the income / expense entries. Note, the most common selection is Posted date, but it primarily depends on the date used for your financial reports |

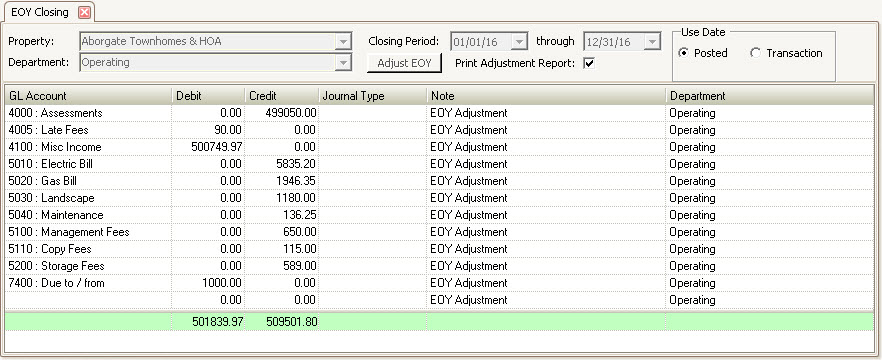

How to post End Of Year entry:

1.Select the property

2.Select the department

3.Select the Closing Year range (generally pre-defined for the prior year)

4.Select the desired Use Date option

5.Press Adjust EOY

The program will calculate the reversing entries for all income and expense accounts.

6. Select / enter the retained earnings account on the last row of the grid, tab out of the GL Account field, the system will calculate the debit or credit amount, verify the amount calculated and press Post ![]() to complete the journal entry.

to complete the journal entry.

7. Repeat steps to process each department.

|

With proper security rights, a user can delete unreconciled journal entries through GL Inquiry if the wrong entry was posted,allowing you to recreate the EOY journal entry again. |

|

If you attempt to do EOY Closing for a department without selecting a Capital Account, leaving an unbalanced journal entry, you will get the error "Error account entries out of balance for department: Department Name.". |