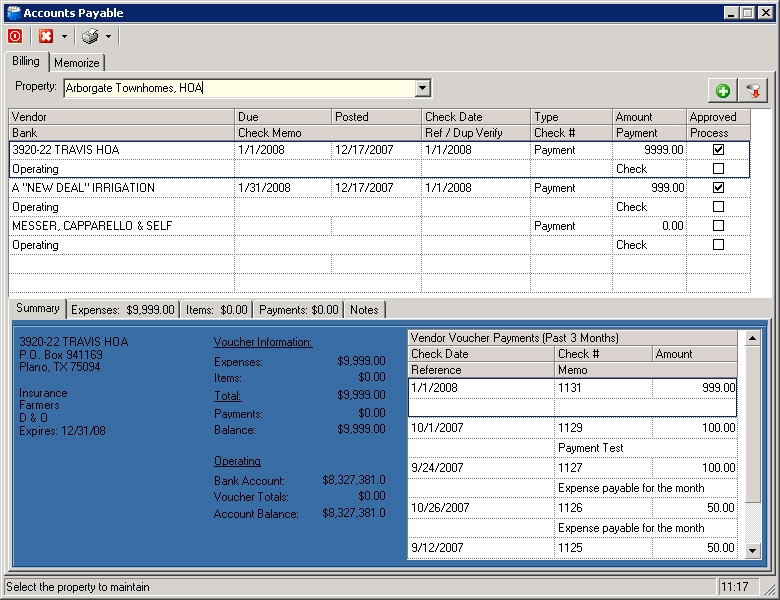

The Billing tab is used to create or maintain current vouchers in the Accounts Payable system. A voucher is defined as various expense items attached to a single vendor and bank. The A/P program allows a user to enter a voucher, define the vendor and bank, and then add expenses or predefined items to the voucher for check payment as needed.

|

There are two dates for every G/L entry posted into the system from the A/P system, known as the Posting Date and Transaction Date. |

Posting Date |

The current date or the entered Posted Date the A/P voucher is Approved or Processed into the system |

Transaction Date |

Either the entered Invoice Date for each expense or the current date if no Invoice Date is entered |

The significance of the transaction date depends on how the user generates their G/L reports. Users have the option of entering search parameters for either transaction or posting dates. See Setup/Report Groups and Selection Parameters/Report Parameters for more information on dates' relations to reports.

Posting scenarios

Accrual-Based Accounting

| 1. | After a voucher is added to the system and approved, the program will post G/L journal entries using the defined Accounts Payable G/L account (see: Property Setup/Accounting/AP) and each expense account. |

| 2. | When a check is printed for vendor, the program will create an offset entry to the defined Accounts Payable G/L account and adjust the bank account defined within the voucher. |

Cash-Based Accounting

| 1. | When a check is printed for a vendor, the program will create a journal entry for the expense as well as the bank account defined within the voucher. |