What is a "lockbox file"? A lockbox file is a specially formatted file that comes from the bank with payment information for the properties that use them. When an owner sends a payment to the bank, the bank then collects certain information from the check and/or the payment coupon and enters it on a special file. This lockbox file received from the bank will have an unique extension based on the agreed to naming convention between the bank and VMS (ask your bank representative or VMS support team member what the extension is for your bank).

A lockbox file is saved within the VMS Lockbox Data folder and based on the extension of the file, VMS will be able to read it when the user goes to APPLICATIONS | Account Maintenance Group | Lockbox for processing.

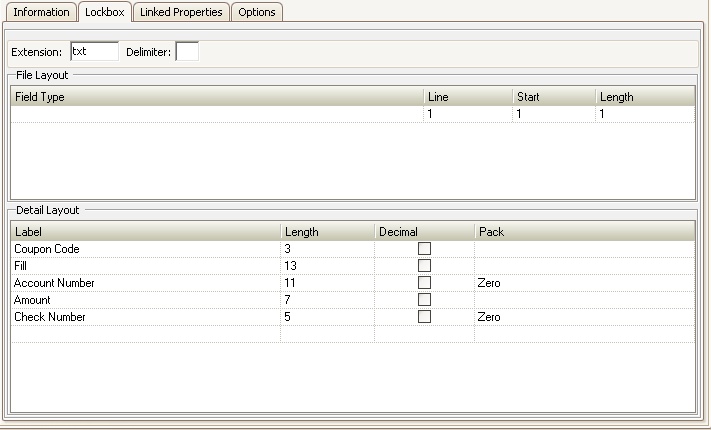

First, the lockbox files received from the bank need to be setup here so the system can read the file and allow the user to process payments. Each bank has their own specific Detail Layout that needs to be established here.

How to setup the Detail Layout:

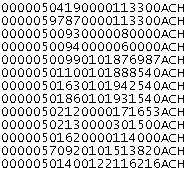

The Detail Layout can be defined by looking at the file received by the bank.Here is an example of what a lockbox file would look like when the user creates an ACH file:

In looking at the information above, if you are familiar with your properties, you can distinguish the sets of numbers in each row. Using the information in a row can help you determine your Detail Layout.

1. Determine the Extension name of the file. Each bank has a predefined extension. In this example the Extension field is "txt".

|

You must enter a unique extension for each bank. |

2. Determine the Delimiter. This can either be left blank, have a comma, or another type of punctuation depending on if the lockbox file uses punctuation. Most banks do not use punctuation so this field is left blank.

3. Pick one row from the lockbox file to work on. For example: 00000500990101876987ACH

4. Working from left to right, we know that the system's account numbers begin with a 5, for example, and that they are 5 digits long. So, 50099 is the Account Number.

a. Since the account number can be longer than 5 digits, it needs to be able to grow. Therefore there are extra zeros in front of the account number. This makes the account number 10 digits long.

5. The next set of numbers in the row is 0101876987 and might need a little more research. In going to account #50099 in VMS, you will see that this was a payment applied to the owner's account that matches this order of numbers. It is also a 10 digit number. So this is the Amount.

6. And finally, the ACH at the end tells VMS that it was an ACH payment from an owner. This will go in the Check # field in the owner's account.It's only 3 characters. So this is the Check Number.

a. If this was a payment received by the bank instead, an actual check number would be in this space.

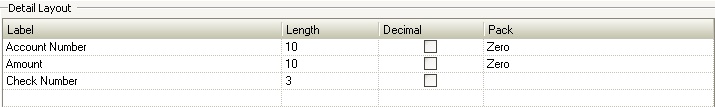

7. In this example, the definition would look like this: