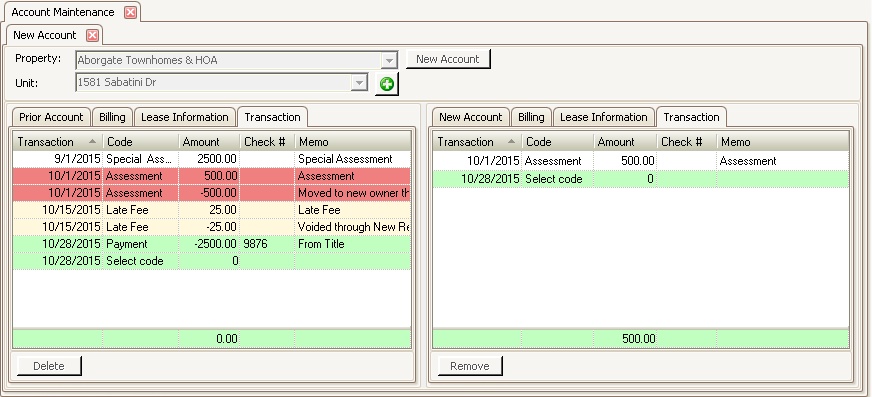

The Transaction tab allows the user to click and drag any transaction records from a prior account to the new account, void a prior transaction (i.e.: late fees) from the prior account and allow for the entry of additional transactions on both accounts.

This example shows a couple of common entries that can be managed through this area:

1.An assessment dated 10/1/15 for $500 was moved to the new account, which created an offset record with a date of 10/1/15 for -$500 on the prior account.

2.The Late Fee of $25 was voided, which created an offset adjustment record of -$25.

3.A payment was added to bring the prior account to $0.00.

How to manage transaction records:

During an account transfer, transactions can be entered for both the prior and new accounts before posting the changes.

1.Select the Transaction tab for the prior or new resident.

2.Move a transaction by clicking the desired prior transaction entry and dragging and dropping the item to the new account.

3.Select a transaction for the prior account and pressing the Void button creates an offset adjustment record to the prior account.

4.Enter a new transaction for either the prior or new account by selecting the last row of either transaction grid, selecting the posting code to post, entering the amount of the transaction, check number and memo.

|

When adding or moving any credits to either account, the system will create a Cash adjustment batch for the user managing the accounts. The batch must be posted manually through Adjustments in order to update the accounts. The idea is to post all of the cash receipts for new accounts and create one deposit batch. |

|

When a transaction on the prior account is selected, a Void button, |