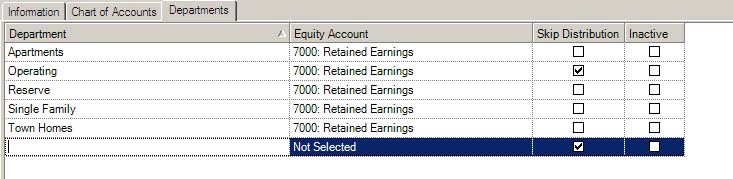

This screen is used to define the General Ledger departments (also known as "cost centers" or "funds"). By defining various departments, the VMS report generator will have the capability to generate reports by fund, allowing for balance sheets and profit / loss statements to have separate reporting of each department.

Example:

A/R: As charges and payments are posted through the A/R module, VMS will automatically assign the posting amounts to the default G/L department defined (see Setup/Property Setup/GL Setup/Information), unless the A/R Posting code has a G/L Department defined specifically for the posting code (see Setup/Property Setup/AR Setup/AR Posting Codes).

A/P: When A/P vouchers are created for invoice payment, the user can select a specific department to apply the expense amount to or if distributing an amount, A/P can equally distribute the amount entered to all non-skipped departments (see below).

G/L: Any journal entry can be entered with a specific department, although there must be another entry to the same department for the other side of the entry to balance the department entry.

The fields are further defined:

Field |

Description |

Department |

Enter the G/L department that can later be used to assign posting at the company, community or A/R posting code level (See Property Setup/Accounting/AR/Posting Codes Department). |

Equity Account |

Enter the corresponding equity account from the drop-down menu of G/L accounts, which is used to automatically calculate the retained earnings for the department on the balance sheet based on the date period the report is printed. Based on the defined code, the report generator will look at the date used to render the information to determine the retained earnings, which is calculated from the net income value. Based on the current period from the report parameter date, the program will calculate the current net income and anything else will be moved to the retained earnings account.

If a code is not defined, VMS assumes there will be a journal entry made to move the net income to retained earnings (see Entry/General Ledger/EOY Closing). |

Skip Distribution |

Used in A/P when entering expenses, if checked, the program will not automatically distribute the expense amount entered to this department when Distribution is selected as the department during the approval process.

Example, if a master planned property has three departments defined to represent multiple communities within the property named Single Family, Town Homes and Apartments, A/P will allow you to equally distribute the expense amount entered between all departments, thus spreading the cost of the expense to all departments not checked for skip distribution.

Unless there is a specific need to distribute, it is best practice to uncheck your default department (see Setup/Property Setup/GL Setup/Information) and check all other defined departments, which will shut off the feature through A/P. |

Inactive |

The department can be deleted if it has never been used and if it is not defined for other accounting purposes; otherwise, you must make the department inactive to avoid using it in other modules in the system. |

|

There must be at least one department defined if you are going to post to the General Ledger, which is then assigned to the company through Property Setup/Accounting/GL Setup/Information. |