As each resident is being processed through billing and charges are added to the account, the billing program determines if the resident has an entered ACH record. If so, the program will look at the start date of the record to make sure it is before or equal to the current billing date and the record is set up for automatic payments (see Entry/Accounts Receivable/Account Maintenance/ACH). If all of the conditions for processing the payment are met, the billing program modifies the ACH record to reflect the payment amount equal to the billed amount.

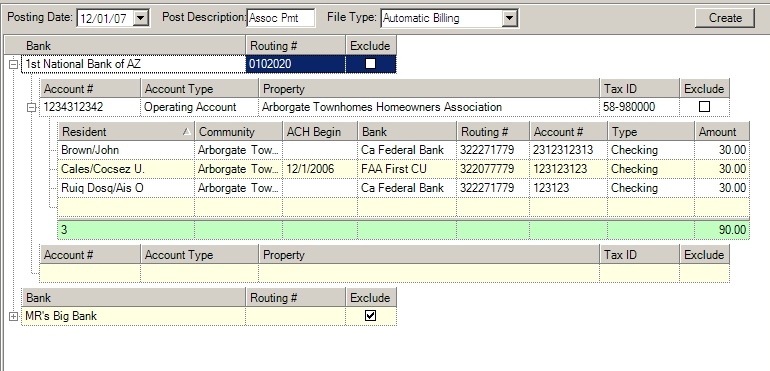

At this time, the user must select a file type from the drop-down menu to display a screen like the following:

The Bank fields are further defined:

Field |

Description |

Bank |

Displays the bank that was added and linked to the property in Setup/Program Defaults/Banks. |

Routing # |

Displays the routing number entered in the ACH tab in Setup/Program Defaults/Banks. |

Exclude |

A check-mark indicates that the entire bank will be excluded from the ACH process. |

The Account fields are further defined:

Field |

Description |

Account # |

Displays the account number that relates to the property, as defined in Setup/Property Setup/Accounting/GL/Chart of Accounts. |

Account Type |

Displays the type of account that relates to the property. |

Property |

Displays the name of the property that contains ACH data. |

Tax ID |

Displays the Tax ID number entered in Setup/Property Setup/Accounting/Information. |

Exclude |

A check-mark signifies that the entire property will be excluded from the ACH process. |

The Resident fields are further defined:

Field |

Description |

Resident |

Displays the name of resident who has entered ACH information. |

Community |

Displays the name of the community in which the selected resident resides. |

ACH Begin |

Displays the ACH begin date if entered (optional). |

Bank |

Displays the name of the resident's bank. |

Routing # |

Displays the routing # of the resident's bank. |

Account # |

Displays the resident's account number. |

Type |

Displays the type of bank account entered for the resident. |

Amount |

Displays the community's billing amount if entered for Automatic Billing. If Automatic Balance is selected, the resident's owed balance will populate in this field. A zeroed amount will remove the resident from the file. |

|

Note that all resident information displayed within the expanded record (+) is defined in Entry/Accounts Receivable/Account Maintenance/ACH. |

The following information describes how the program determines the automatic processing of an ACH file:

•The program displays all banks affected by the billing process that have ACH payments pending for creation. The user can expand the bank to reveal the properties that have pending payments, and expand the property to display each resident.

•The user can modify the processing amount by changing the amount, clear the payment by entering 0 in the amount field which will remove the record for processing, or click in the blank row to add any additional residents to the list for processing.

•If a bank or property is not ready for processing, you will want to exclude the entity from the ACH file. Select the Exclude checkbox next to either entry to avoid processing; selecting the Bank Exclude checkbox will avoid processing all properties defined for the bank.

•Click the Create button to create the ACH file, which will be added to the export folder defined for the VMS software. During the creation phase, the program will print a report of all ACH payment requests (if defined) and create a lockbox file to be processed through the Lockbox module (see Accounts Receivable: Lockbox). The user can elect to process the lockbox file when you would like to add the payment records to the affected resident accounts.

•When the process is complete, no items will be listed under the bank and the file is ready to be sent to the bank according to the predefined procedures of the financial institution.