The billing information is used by two VMS billing modules: Billing and Late Fee.

|

You must enter the Posting Codes through AR Posting Codes before entering billing information. |

Billing Type

This drop-down is used to define billing for a specific module in the system and is further defined:

Item |

Description |

Billing |

This selection allows the user to enter billing information for the accounts defined within a community (see: AR Billing) |

Late Fee |

This selection is used to define the late fee charges processed through Accounts Receivable (see: AR Delinquency). |

Transfer Fee |

This selection is used for reporting purposes and does not have a direct impact to any module. |

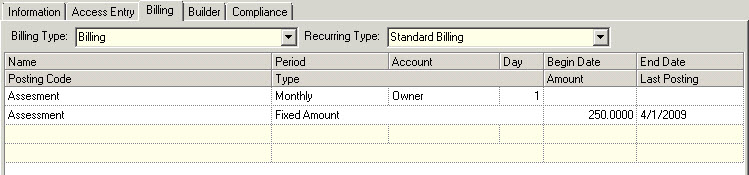

Billing

The system allows for multiple communities to be added within a property. Units are added to a community and an account is added to a unit. Each community can have different billing records defined, which are used to post specific charges to the units within a community.

Recurring Type

The Standard Billing selection is used to post recurring charges to all units within a community, but other recurring billing matrices can be created and attached to an owner account and/or a unit (example boat slip, casita) to post additional charges when A/R billing occurs (see: AR Billing) (see: Unit Maintenance).

|

Other than the Standard Billing, additional Recurring Types must be entered through Program Defaults/Codes (see: Codes) |

Billing Posting Grid

The posting grid fields are further defined and should be entered in by the order of this list:

Field |

Description |

Name |

Enter the name used to describe the billing item; if this item is an assessment, the coupon processing module will use this description on the printed coupons. |

Period |

Enter the frequency of the billing items. |

Account |

This drop-down is used to define the A/R account type for the entered billing information. This list is populated using the entries defined through Program Defaults/Account Types, but only types defined with the Billing checkbox (see: Account Types)

Note: A special Account Type in the list is Unit. Adding billing records using the Unit type tells the system to post Unit Recurring Billing charges to any active account attached to a unit when the Recurring Billing type is defined (see: Unit Maintenance). |

Day |

Enter the day the item should be posted to the system within the selected period. The same procedure applies to implementing a late fee. |

Begin Date |

Optional. Select the date to begin charging an item. This is most often used to bill assessments during specific months (i.e.: hurricane assessments). |

End Date |

Optional. Select the date to stop charging a given item. This date is used by the coupon, EOM and late fee processing modules to determine if the billing item needs to be processed. |

Posting Code |

Select the correct posting code for the billing item; the type of posting code will determine the billing type. Posting codes are defined in AR Posting Code. |

Type |

Depending on the Posting Code selected, the program will change the type of drop-down menu accordingly.

Assessment Fixed: The amount entered for this item is a fixed amount and posted to the account as entered.

% of Unit Value: The posting module will multiply the Amount by the Unit Assessed Value entered for the unit (see Unit Maintenance Unit Value). For example, if the amount entered is 100,000.00, the program will calculate [100,000 x Unit Assessed Value] to determine the assessment amount. The VMS program will also calculate this to the nearest dollar or tenth, which can be selected on the drop-down menu.

% of Unit Value Round Dollar: See % of Unit Value.

% of Unit Value Round Tenth: See % of Unit Value.

Sq.Ft. Calculation: The posting module will multiply the amount entered by the unit square footage value entered; this is also known as Mill Rate calculation (see Unit Maintenance Acreage). |

Amount |

Enter the amount posted or calculated based on the Type selected. |

Last Posting |

This field does not need to be entered, but it can be changed if it is necessary to reprocess a charge sequence through either AR Billing or AR Delinquency Control, in the event a mistake was made in either module and a batch void is used to remove invalid charges. If a batch void is processed, the date must be back dated to force the program to reprocess the charges. |

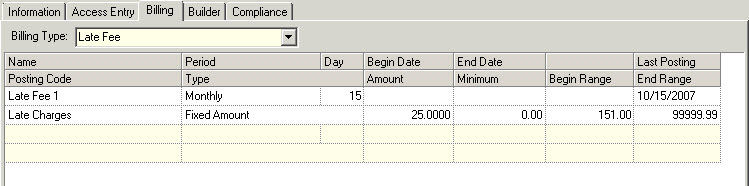

Late Fee

Billing Posting Grid

The posting grid fields are further defined and should be entered in by the order of this list:

Field |

Description |

Name |

Enter the name used to describe the billing item; if this item is an assessment, the coupon processing module will use this description on the printed coupons. |

Period |

Enter the frequency of the billing items. |

Day |

Enter the day the item should be posted to the system within the selected period. The same procedure applies to implementing a late fee. |

Begin Date |

Optional. Select the date to begin charging an item. This is most often used to bill assessments during specific months (i.e.: hurricane assessments). |

End Date |

Optional. Select the date to stop charging a given item. This date is used by the coupon, EOM and late fee processing modules to determine if the billing item needs to be processed. |

Last Posting |

This field does not need to be entered, but it can be changed if it is necessary to reprocess a charge sequence through either AR Billing or AR Delinquency Control, in the event a mistake was made in either module and a batch void is used to remove invalid charges. If a batch void is processed, the date must be back dated to force the program to reprocess the charges. |

Posting Code |

Select the correct posting code for the billing item; the type of posting code will determine the billing type. Posting codes are defined in AR Posting Code. |

Type |

Late Fee Defined late fees are used to create a charge on accounts that are delinquent, without the ability to automatically generate letters for late fees charged. See Delinquency Control Setup if the need to manage letters and charges is necessary for the property.

Fixed: The amount entered for this item is a fixed amount and will be posted to the resident account as entered.

% of Balance: The amount entered for this item is multiplied by the current resident balance and posted to the account. For example, if the percentage entered is equal to 12, the program will calculate [(12/100) x Balance] to determine the late fee amount.

Special Assessment The billing selection types in this section are the same as in Assessment. If a special assessment is entered as a billing type, the VMSXChange module will use this billing information for resale disclosure letters. |

Amount |

Enter the amount posted or calculated based on the Type selected. |

Minimum |

Enter the minimum amount to charge to an account when % based calculations are used |

Begin Range |

Optional. This is used by the Late Fee posting module and allows users to set a threshold for late fee based on the balance of the account. For example, if the Begin Range is equal to 100, the late fee posting module will evaluate the balance of the resident and post the fee if the balance is greater than 100. |

End Range |

Optional. This is used by the Late Fee posting module and allows users to set a threshold for late fee based on the balance of the account. For example, if the End Range is equal to 999, the late fee posting module will evaluate the balance of the resident and post the fee if the balance is greater than the Begin Range and less than the End Range. |